Five top tips to prevent your card being hacked

Whilst almost half of Europeans worry about the safety of their data, and 59% experiencing data protection issues in the past, there are steps you can take to protect yourself from card fraud. Read below for our five top tips to protect yourself from credit or debit card hacks.

#1: Text message notifications for suspicious transactions

Enabling SMS notifications for unusual transactions means you will be notified the minute any suspicious activity takes place from your account, and gives you a better chance to contact the bank and prevent more damage from happening. These can be enabled in the settings on your online banking platform and can prevent you finding out if you have been hacked the hard way (for instance your card declining in a shop). If in doubt, have a Google and see if this is a service your bank offers.

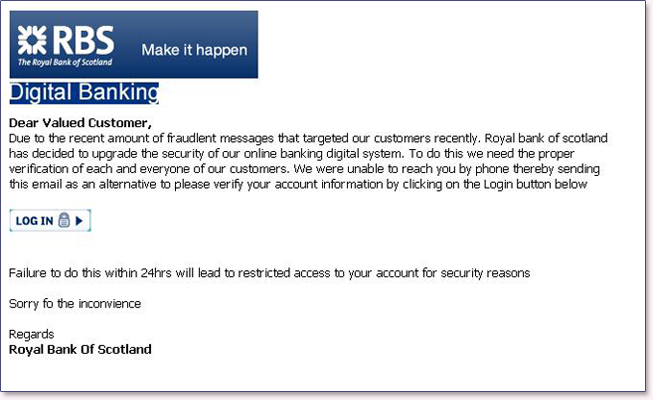

#2: Don’t fall for phishing scams

Phishing emails from scammers pretending to be your bank (see below example) entice you to ‘login’ to a fake bank page, which then records all of your data. Don’t become a victim of these scams – if you are ever in doubt about whether an email is legitimate, always contact the company directly and ask.

#3: Make sure companies you make payments with are PCI DSS compliant

When making a payment over the telephone, make sure you are offered the chance to enter in your card details yourself and don’t give an operative the chance to write them down! You can check out our brochure here which explains what PCI DSS compliance is.

#4: Be careful with your choice of retailer when shopping online

Make sure to read customer reviews. If there are many reviews criticising the order process, then go with another retailer. Make sure the website is secure by looking for lock images in your browser’s status bar.

#5: Use your card provider’s online authentication service

One example (also used in our solution – check it out here) is 3D Secure, which is an additional layer of security by adding a password & secret phrase which can then be entered by the consumer when making an online payment – if the user does not know the password, then the transaction cannot continue. This service is also known as ‘Verified by Visa’ and ‘MasterCard Secure Code’.